Brazil was the ninth biggest recorded-music market in the world last year according to the IFPI, with strong domestic growth and increasing cultural clout globally. 2024 is continuing in that vein according to figures published by labels body Pro-Música Brasil.

Recorded-music revenues from streams and sales grew by 21% in the first half of this year to R$1.44bn ($256.4m at current exchange rates). Well, we say ‘streams and sales’ – 99.2% of these revenues came from streaming, so it’s absolutely dominating the market.

Pro-Música Brasil noted that streaming subscription revenues were up 28.4% in the first half of this year to R$995m ($177.2m) thus accounting for nearly 70% of the overall market. Ad-supported streaming revenues grew by 6.6% to R$436m ($77.6m) meanwhile.

The 28.4% growth in subscriptions is particularly encouraging, since those revenues grew 21.9% in 2023. An acceleration of paid-streaming growth in one of the industry’s key ‘high-potential’ markets will be welcomed by rightsholders.

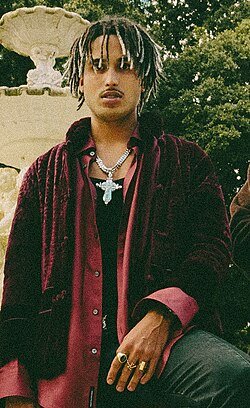

“The 21% growth in the sector’s digital and physical revenues directly reflects the efforts and investments made by recording companies, both in the production of musical content nationally, as well as in the marketing, promotion and career development of thousands of Brazilian artists,” said president Paulo Rosa.

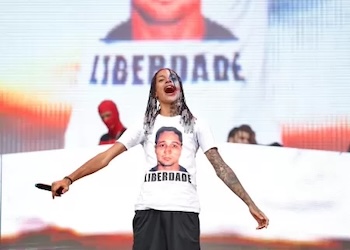

The news comes at an exciting time for the Brazilian industry, with a number of recent announcements. Warner Music Brazil invested in local DSP and distributor Sua Música in July, the same month that Spotify announced plans for its largest concert yet, in São Paulo.

One question that the half-year figures sparks is this: how high can Brazil and its Latin American compatriot Mexico rise in the global recorded-music rankings? Last year they were ninth and 11th respectively.

2024 may well be the year when Latin America has two countries in the IFPI’s top 10. That, along with China’s potential to overtake Germany as the world’s fourth largest market – their growth was 25.9% and 7% respectively last year, with China only $165.9m behind – is truly a reflection of the shifting sands of the global music industry.